Exploring the Most Important Trends of Impact Investing in 2022

Impact investing as a sector has risen considerably over the last several years, and 2022 has witnessed so far the emergence of more mainstream market participants and the rapid expansion of climate financing. In this pursuit, the Global Impact Investment Network (GIIN) estimates the size of the global impact investing industry to be $1.164 trillion, marking the first time the organization’s widely accepted estimate has surpassed the $1 trillion threshold. Overall, impact investing is preparing to provide demonstrable positive effects on financial and social returns.

Moving forward, we will explore the key drivers and most relevant impact investment trends in 2022.

Uncovering the Variables Driving Impact Investing

Amit Bouri, the GIIN co-founder and CEO, declares: “While the market growth to over 1 trillion serves as a very positive sign for impact investing, it is also a call for further action. Investing more capital with an intentional focus to generate positive impact is required right now if we truly want to meet the UN Sustainable Development Goals by 2030 and achieve net zero emissions by 2050.”

Source: Schroders

To comprehend what drives impact investors, it is important to define the most important aspects that impact their decisions:

- Intentionality – Effect investing requires an investor’s aim to create a beneficial social or environmental impact via investments.

- Expected Returns – It is anticipated that impact investments would yield a financial or, at the very least, a return on capital.

- Impact Measurement – Without a doubt, the defining characteristic of impact investing is the investor’s commitment to assess and disclose the social and environmental performance and development of underlying investments, assuring transparency and accountability while enriching the practice of impact investing and expanding the field.

- Asset classes – Impact investments may be undertaken across a multitude of asset classes, such as cash equivalents, private equity, fixed income, and venture capital. Overall, investors aim for financial returns ranging from below-market (often referred to as concessionary) to risk-adjusted market rate.

Increasing the Focus on the Climate Emergency

So far, in 2022, the primary emphasis has been on addressing environmental concerns and climate change. With COP26, the idea gained pace and expanded into a climate finance-related movement in both the financial and business sectors. However, according to past UN research, governments and corporations would need to contribute an additional USD 700 billion yearly over the next decade to safeguard and restore the planet’s ecosystems. Major institutional investors are reviving their interest in impact investing as a means to advance climate concerns and eventually realize their net-zero goals.

Source: Met Office

Institutionalising Impact Investing & ESG

Previously, impact investing was perceived as a niche focus, but investors are now experiencing a landslide as private bankers and asset managers concentrate on achieving net positive investments via collaboration.

While the central subject of the G7 Impact Taskforce was mainstreaming impact investment, there is a growing emphasis on mobilizing private sector funds through composite financing and co-investment methods in conjunction with multilateral development. Impact investment is seen as a growth pillar by transforming the financial sector to net-zero emissions.

More Responsibility & Accountability for Investors

2022 was the beginning of a whole new age of responsibility for investors who stake a claim to the impact label is about to begin due to a combination of heightened criteria and greater levels of scrutiny. IRIS+, the Sustainable Development Goals (SDGs), and the Effect Management Project (IMP) are examples of frameworks and technologies that have contributed to developing a worldwide agreement on defining, quantifying, and measuring impact.

Nevertheless, there is still a lack of cohesion in impact measurement, and attempts are now being made to connect top sustainability and integrated reporting groups, in addition to continuing activities to unify global sustainability reporting standards.

Assessing & Evaluating Impact over Time

Developing the ability to analyze and quantify the real effect made by an investment over time is another core advancement in the field of impact investing. There has been a change in attention away from analyzing the financial success of investments and toward adding quantifiable consequences on society and the environment. Furthermore, the magnitude of these effects may be estimated based on higher economic and social standards as well as lower environmental dangers.

Evaluating the effect consists of several ways, some of which include impact assessment frameworks, performance reports, and direct measurement of an influence. Performance reports focus more on the results, while direct measurement provides more granular data.

Acknowledging the Financial Viability of Impact Investing

Impact investing was initially hindered by an erroneous perception that socially and environmentally responsible investments entail a trade-off in financial profitability. Recently, these assumptions have been debunked as impact investing has been proven to be more viable than other types of investments. According to one study conducted by the Global Impact Investing Network (GIIN) and JPMorgan, 55% of the possibilities for impact investing result in returns that are competitive with market rates.

Source: Trustnet

Furthermore, in another research published by Moneyfacts, which compared the performance of ethical funds to that of their mainstream peers across four distinct time frames and within five distinct categories or sets of funds, ethical funds were found to have outperformed their mainstream peers in 13 out of the total 20 possible scenarios. In addition, ethical funds have seen an average increase of 16.8% compared to 15.2% for the typical non-ethical fund.

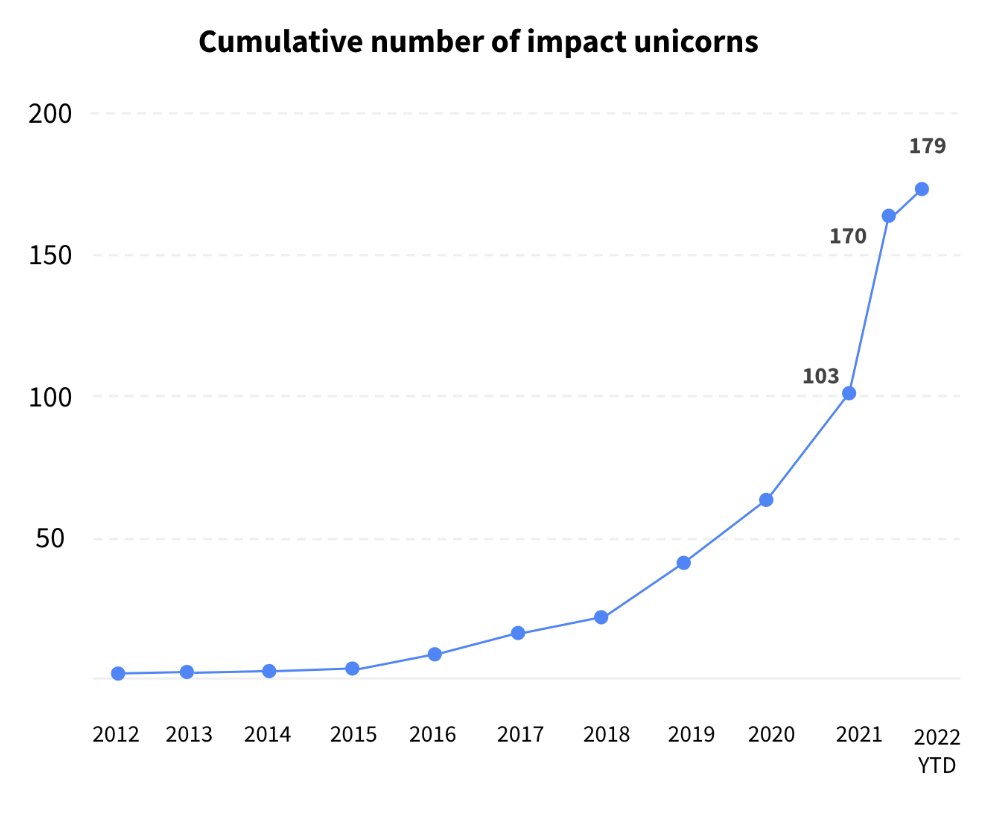

Technology Gains Prominence Among Investors

Nowadays, investors are also turning technology into a solid investment avenue due to its capacity to provide sizeable profits and make operations more efficient and streamline the transitions towards impact business endeavors. Examples of these kinds of technology include AI, carbon capture technologies, Health Tech, and AgriTech.

As the globe grows less reliant on fossil fuels, new environmentally friendly technologies will develop to fulfill the need for energy sources that are both sustainable and low in carbon emissions. In this effort, green technology is becoming a key sector for sustainable and green growth. This sector has the potential to yield high returns for investors who are committed to taking risks in what is deemed to be an emerging space. In this context, green growth is garnering a rising amount of attention worldwide, which has increased demand for low-carbon energy sources that support the development of sustainable industries.

Source: DealRoom

Concluding Remarks

In 2022 and beyond, impact investing will continue to promote and grow sustainable investments, therefore putting more organizations on the road toward reinventing the impact investing paradigm focused on more than just financial returns.